is a car an asset for medicaid

And if the transaction is for fair market value and a fair interest rate there should be no transfer-of-asset issue if it is taken out within the five years before applying for Medicaid. This implies that Medicaid insurance will not count some assets in its checklist to see if the Medicaid applicant qualifies.

What Medicaid Considers An Asset In New York Theodore Alatsas

Blunt the monthly income might be a problem UNLESS they would consider my Dads residential care facility costs as a spend down in which case they would qualify.

. Every other number minus the one non-countable asset is regarded as a countable asset and will be taken into account to sell off and pay any healthcare debt that you might be owing after your death. In most states this limit is 2000. However a Medicaid caseworker may consider an extravagant purchase an exotic or luxury car to be a investment and therefore a countable asset.

In the state of Florida you are allowed to keep your primary residence cars and irrevocable funeral plans. The car has to be bought for transportation purposes not as a luxury item. You can own an automobile and qualify for Medicaid.

Personal property The one caveat here is that like the extravagant car noted above spending too much on items like jewelry or art could be considered an investment and therefore a countable asset. After the first vehicle of any value any vehicle more than 7 years old is not counted. However in 2022 in no case can a spousal income allowance put a non-applicants monthly income over 3435.

Other vehicles are generally considered extra unless they are very damaged or undriveable. The state will increase Medicaids asset limit from 2000 for an individual to 130000 and from 3000 for a couple to 195000. Your Medicaid coverage will be stopped because it shows you can pay for your healthcare cost yourself and you can be charged for fraud.

A The answer is probably yes but it depends on the circumstances. Medicaid also takes your vehicle into account as an asset and limits each Medicaid recipient to one non-countable vehicle in order to qualify. If you violate the rules of Medicaid your car will be counted as a countable asset.

And if the transaction is for fair market value and a fair interest rate there should be no transfer-of-asset issue if it is taken out within the five years before applying for Medicaid. The assets that someone is able to keep in Medicaid planning vary from state to state. According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value.

Exempt assets will not be counted when determining your Medicaid eligibility. This could even be a Lamborghini. However the older vehicles may be included if the vehicle is 1.

Under federal regulations one vehicle which in some cases may include a classic car or a luxury car is exempt from. Theres a certain asset limit depending upon which medicaid is provided. You have to be familiar with Medicaid in your state to know when not to buy a car while on Medicaid.

So if your assets surpass this limit youll no longer be eligible for medicaid. A Medicaid client owning an automobile may have the vehicle exempt from being counted as an asset subject to the 2000 limitation on the total value of assets if. Your home car and personal property may be exempt.

The applicants principal place of living is an excluded. The primary residence is protected under. After the first vehicle of any value any vehicle more than 7 years old is not counted.

In Ohio a non-applicant spouse can further increase their spousal income allowance if their housing and utility costs exceed a shelter standard of 68663 month effective 7122 63023. If you own a car you can rest assured Medicaid is not going to hold it against you no matter how much it costs. Hey all- my parents would qualify for Medi-cal as of 7122 since the asset law is changing from 2k in savings to 130k.

This will result in eliminating the value of most vehicles over 7 years old. Funeral and Burial Funds. Yes buying a car while on Medicaid will affect your Medicaid because you would be questioned on how you get the money to buy the car.

Currently the Florida Medicaid policy is to exclude one car of any value or use. But buying a luxury car while on medicaid can disqualify your medicaid. My state doesnt consider the first car as an asset but the equity of the second one is.

The following is a list of exempted resources in assessing a Medicaid applicants eligibility for Medicaid nursing home services. Under certain circumstances you are also allowed to keep IRAs or retirement accounts and rental property. You can also exempt a second vehicle older than seven years old unless it is a luxury vehicle or it is an antique or classic car older than 25 years old.

Even with all that in mind a car is an asset because you can quickly put it on the market and convert it to cash albeit for less than what you. One automobile of any current market value is considered a non-countable asset for Medicaid purposes as long as it is used for the transportation of the applicant or another member of their household. One car according to the policies of the program is a non-countable asset that will not be taken into the account of Medicaid while taking stock of your countable assets.

Generally Medicaid considers the value of any non-refundable pre-paid funeral plan or burial contract exempt. Can my mother gift her car to my daughter without worrying about the five-year look-back period if she applies for Medicaid. The short answer is that the mortgage is an asset and its value is the amount left to be paid on it not the original amount of the loan.

This could even be a Lamborghini. If you violate the rules of Medicaid your car will be counted as a countable asset. This means you can own one Bentley worth over 100000 and that vehicle would not be.

However the reality could be more complicated and.

California Removing Asset Test For Medicaid Eligibility

Spending Down Assets To Qualify For Medicaid Elder Care Direction

Can An Ira Affect Medicaid Eligibility

How Can I Protect My Assets From Nursing Home Care Indianapolis Estate Planning Attorneys

Transferring Assets To Qualify For Medicaid

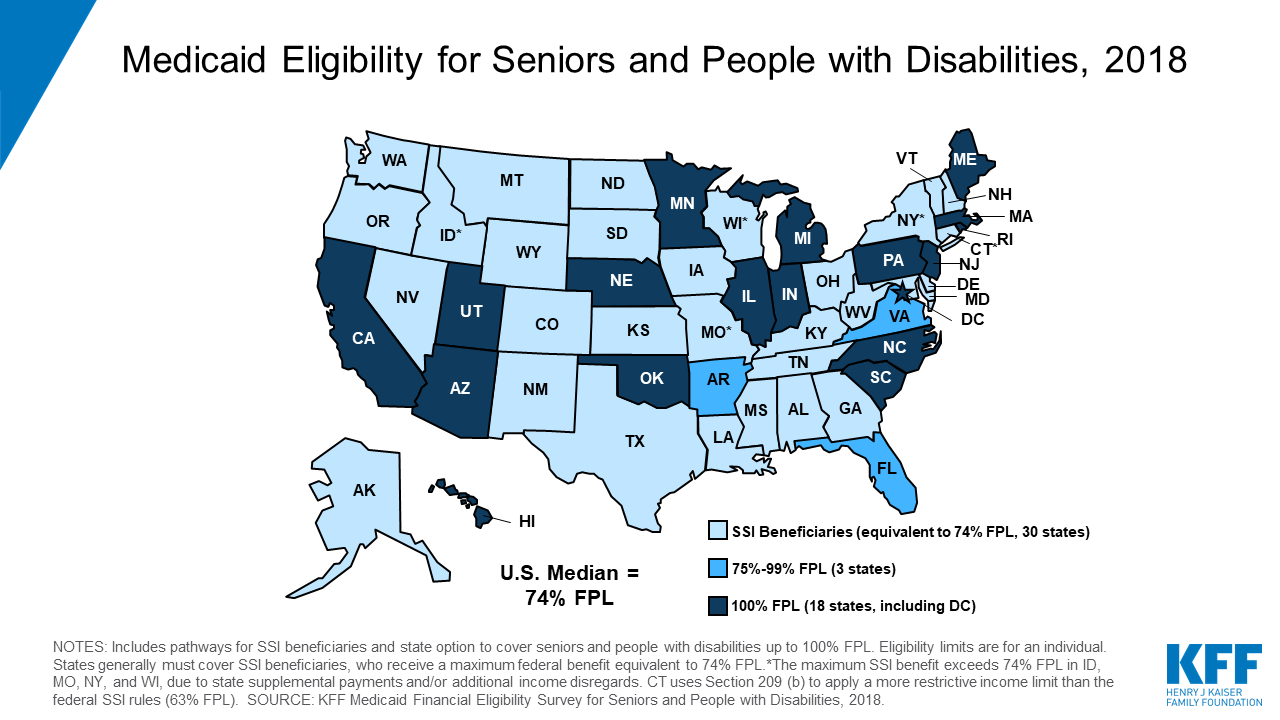

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

How Do Assets Affect Medicaid Eligibility Richert Quarles

Your Guide To Medicaid Countable Assets The Law Office Of Paul Black

Using A Special Needs Trust To Ensure Your Settlement Does Not Affect Public Benefits Anderson O Brien Law Firm

What Are Medicaid Exempt Assets In Pa

Nursing Home Medicaid Tip Single Or Widowed Case Buy A New Car Law Office Of Glenn A Deig

2020 Oh Medicaid Guide Income Limits Exempt Assets Long Term Care

Spending Down Assets To Qualify For Medicaid

Medicaid And Car Ownership What To Know Copilot

:max_bytes(150000):strip_icc()/Familybuyingnewcar_skynesher_CROPPED_Eplus_Getty-2a8c993cd0c146da9cdcd5c293f766b2.jpg)