how do i get my employer to withhold more tax

The IRS issues more than 9 out of 10 refunds in less than 21 days. Think of it as the equivalent of a Social Security number for your business.

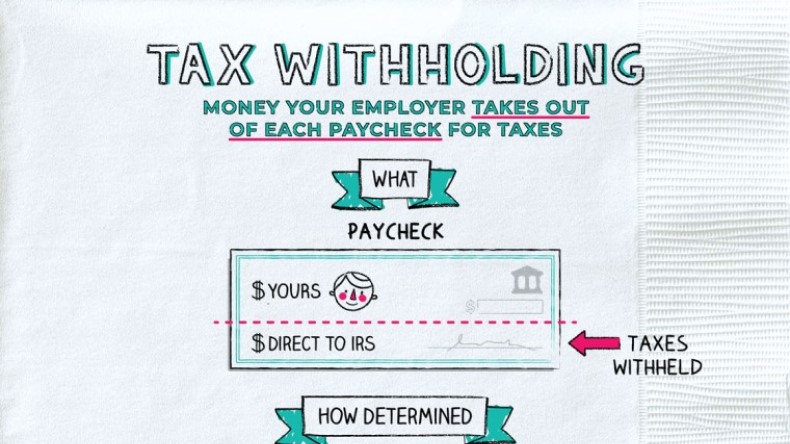

What Is Tax Withholding All Your Questions Answered By Napkin Finance

As the employer you only pay 3625 for Medicare taxes on the employees 250000.

. As an employee you have every right to. A withholding is the portion of an employees wages that is not included in his or her paycheck but is instead remitted. Last year he made 75000 withheld 15000 and collected no government benefits.

The election has no effect on the application of social security Medicare and unemployment taxes. You may also hear it referred to as a Federal Employer Identification Number FEIN or Federal Tax ID number. This is common for an employer to not withhold local tax if the city you work in does not have a tax.

An Employer Identification Number EIN is a nine-digit number used by the Internal Revenue Service IRS to identify a business. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. 1 online tax filing solution for self-employed.

Calculate the Medicare tax for the entire gross wages. Get your tax refund up to 5 days early. Even though the city you live in does have a tax.

An election under section 83i applies only for federal income tax purposes. Fraudulent activity or an abusive tax scheme by a tax return preparer or tax preparation company. Because the employee pays the additional Medicare tax find the total tax amount for 50000.

Medicare is 145 for both employee and employer totaling a tax of 29. Employers wont pay any share of these contributions for their employees. Wisconsin Department of Revenue PO Box 8902 Madison WI 53708-8902.

Send this form in addition to Form 14157. Back to Top. Beginning July 1 2023 youll collect premiums from your employees the same way you do now for Paid Leaveweve updated the Paid Leave reporting system on our end so you can report for both programs at the same time.

Americas 1 tax preparation provider. Youll get a chance to anything needed in that part of the program. The employee might ask what more can the employer possibly do.

Your employer might have withheld taxes but gave you an incorrect W-2. Your employer might have just made a mistake. Need more info on reporting.

Unlike Social Security Medicare taxes do not. Self-Employed defined as a return with a Schedule CC-EZ tax form. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

If the employer wants to get back at a resigning employee they can withhold the last pay as well as your certificate of employment or COE. Social Security is 62 for both employee and employer for a total of 124. This article will answer your question on whether the employer can legally withhold them.

These two taxes aka FICA taxes fund specific federal programs. If your employer didnt withhold the correct amount of federal tax contact your employer to have the correct amount withheld for the future. If this is true your employer must issue you a corrected W-2.

For federal income tax purposes the employer must withhold federal income tax at 37 in the tax year that the amount deferred is included in the employees income. How much will John 75000 No kids get back in taxes. Federal income tax withholding varies between employees.

John is a single 30-year-old with no dependents. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. The employer cost of the Social Security tax is 62.

On the W-4 you may have indicated many more exemptions than you were due in. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or. If will use Turbotax to do your local return.

Tax Return Preparer Fraud or Misconduct Affidavit - Form 14157-A PDF Tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. The employer is using a table based on your W-4 information that you filed with himher to do a look-up in a table to guesstimate a proper amount of withholding. The IRS bases FITW on the total amount of taxable wages.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

What Is Tax Withholding All Your Questions Answered By Napkin Finance

This Quarterly Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Bookkeeping Business Small Business Accounting Business Tax

9 Common Us Tax Forms And Their Purpose Infographic Income Tax Preparation Tax Forms Us Tax

Fillable Form W 4 Or Employee S Withholding Certificate Edit Sign Download In Pdf Pdfrun Online Taxes Federal Income Tax Tax Forms

Fillable Form W4 2015 Edit Sign Download In Pdf Pdfrun Employee Tax Forms Shocking Facts Tax Forms

Irs Improves Online Tax Withholding Calculator Cpa Practice Advisor

What Is Form W 4 Tax Forms The Motley Fool Job Application Form

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From Employee Wages And Self Employed People Need To Payroll Taxes Payroll Small Business Tax

Form W 4 2012 Tax Forms Need To Know How To Get Money

Form W 4 Employee S Withholding Certificate 2016 Mbcvirtual In 2022 Changing Jobs Income Tax Federal Income Tax

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W4 Tax Form Tax

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Fillable Form W4 2013 Edit Sign Download In Pdf Pdfrun Tax Forms Income Tax Payroll Taxes

Employee S Guide To Income Tax Withholding 2022 Turbotax Canada Tips